working capital funding gap

Owning a business may not always be simple but applying with us is. We offer a wide variety of products and constantly look to add to our program offerings.

Vernimmen Com Working Capital Requirement And Financial Debt Where To Draw The Line

Get the financing and support you need to reach your business goals.

. The days working capital is calculated by 200000 or working capital x 365 10000000. Get the financing and support you need to reach your business goals. When a business experiences a short-term gap in working capital they need cash now.

This article presents different ways companies can cover this gap quickly and effectively. Going back to basics we define Working Capital as the funds invested in current. Which of the following strategies is most likely to shorten the working capital funding gap.

Working capital shortages can be created from a number of different business events. Working Capital is a general term for commercial financing. Working Capital Gap.

Ad Turn your outstanding invoices and accounts receivable into working capital. It can also be described. Find out how banks can bridge.

The companys working capital would equal 200000 or 500000 - 300000. In plain terms the working capital deficit is the difference between total liquid assets and total equity other than bank liabilities. Ad Rapid Finance offers small business loans merchant cash advances and lines of credit.

Funding gaps can be covered by investment from venture capitalor angel investors equity sales or through debt offerings and bank loans. It is a measure. The working capital formula tells us the short-term liquid assets available after short-term liabilities have been paid off.

A decline in sales an increase in past due receivables a temporary increase in labor. A funding gap is the amount of money needed to fund the ongoing operations or future development of a business or project that is not currently funded with cash equity or debt. Working capital gap is the excess of current assets as per stipulations over normal current liabilities other than bank assistance.

One of the best advantages is that working capital financing is that you can receive. From global corporate bank alignment risk vs relationship the change in technology and implication of cloud. Keep more inventory on hand.

Provide discounts for customers. Bank assistance for working capital shall be based on. We recognize that all business owners.

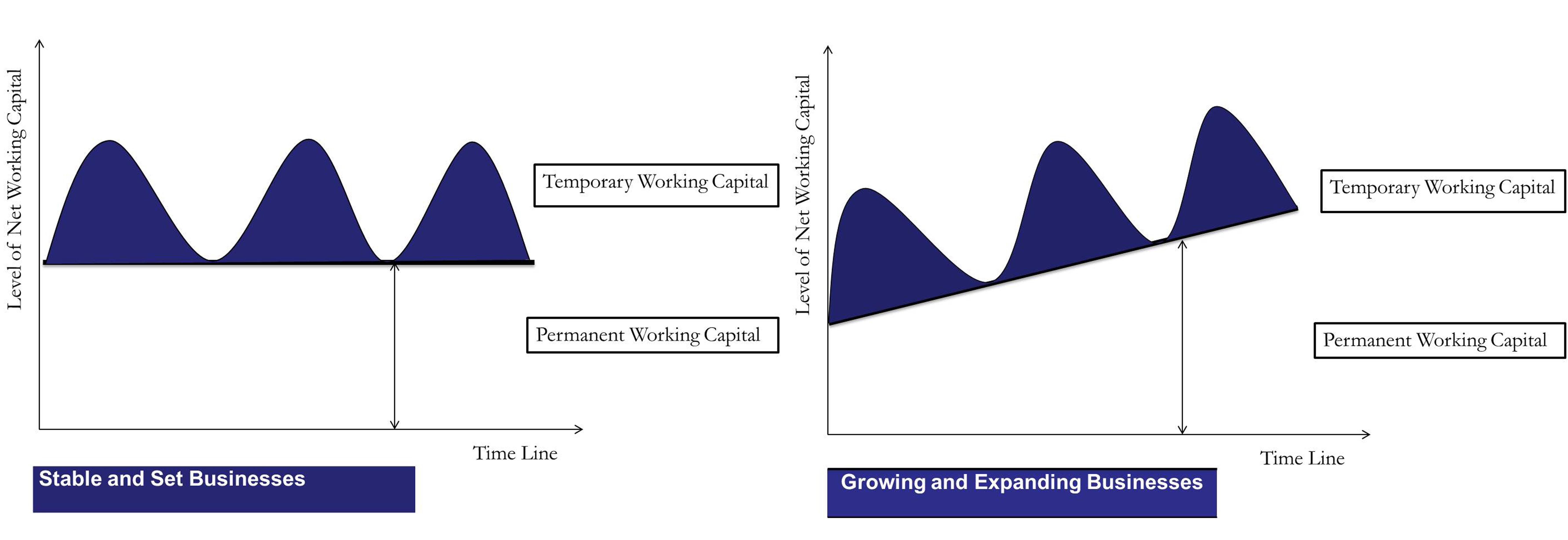

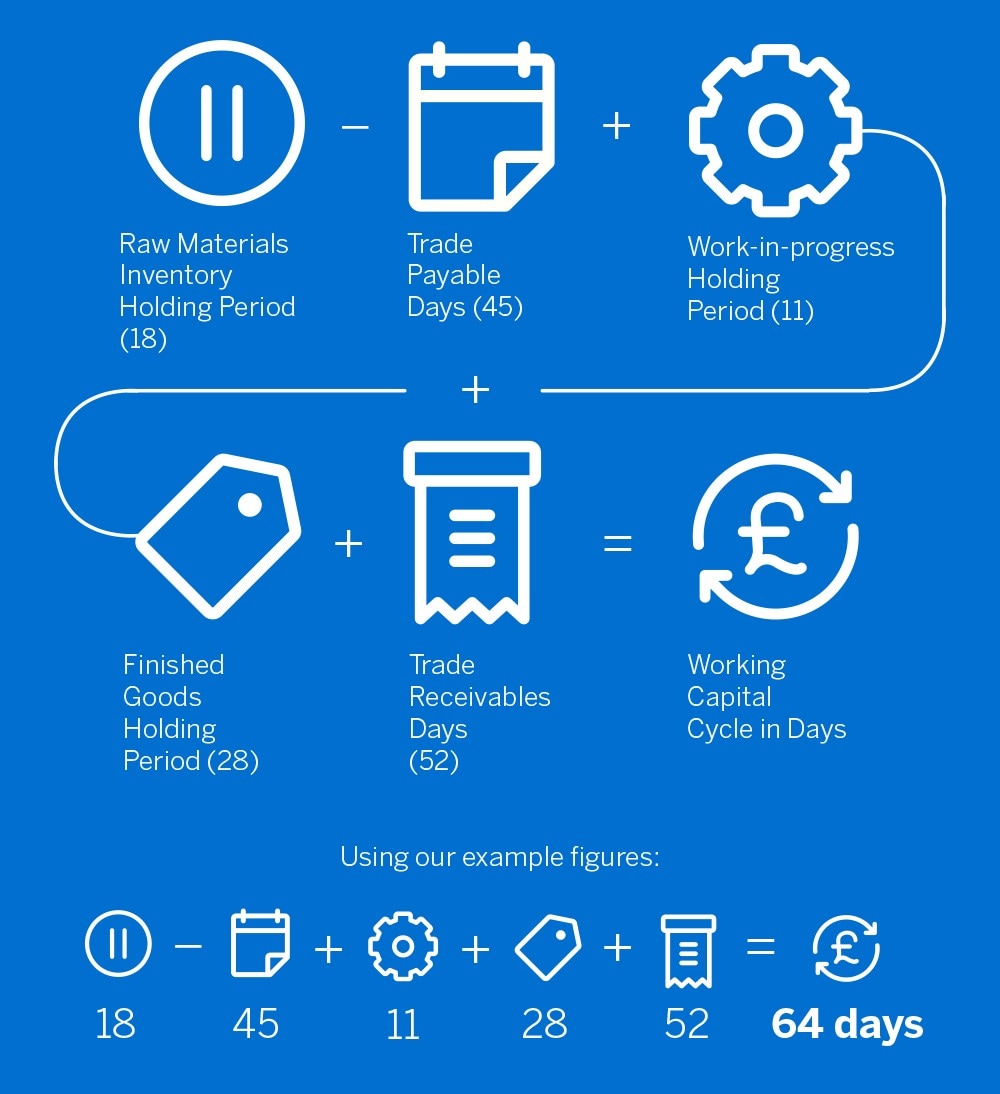

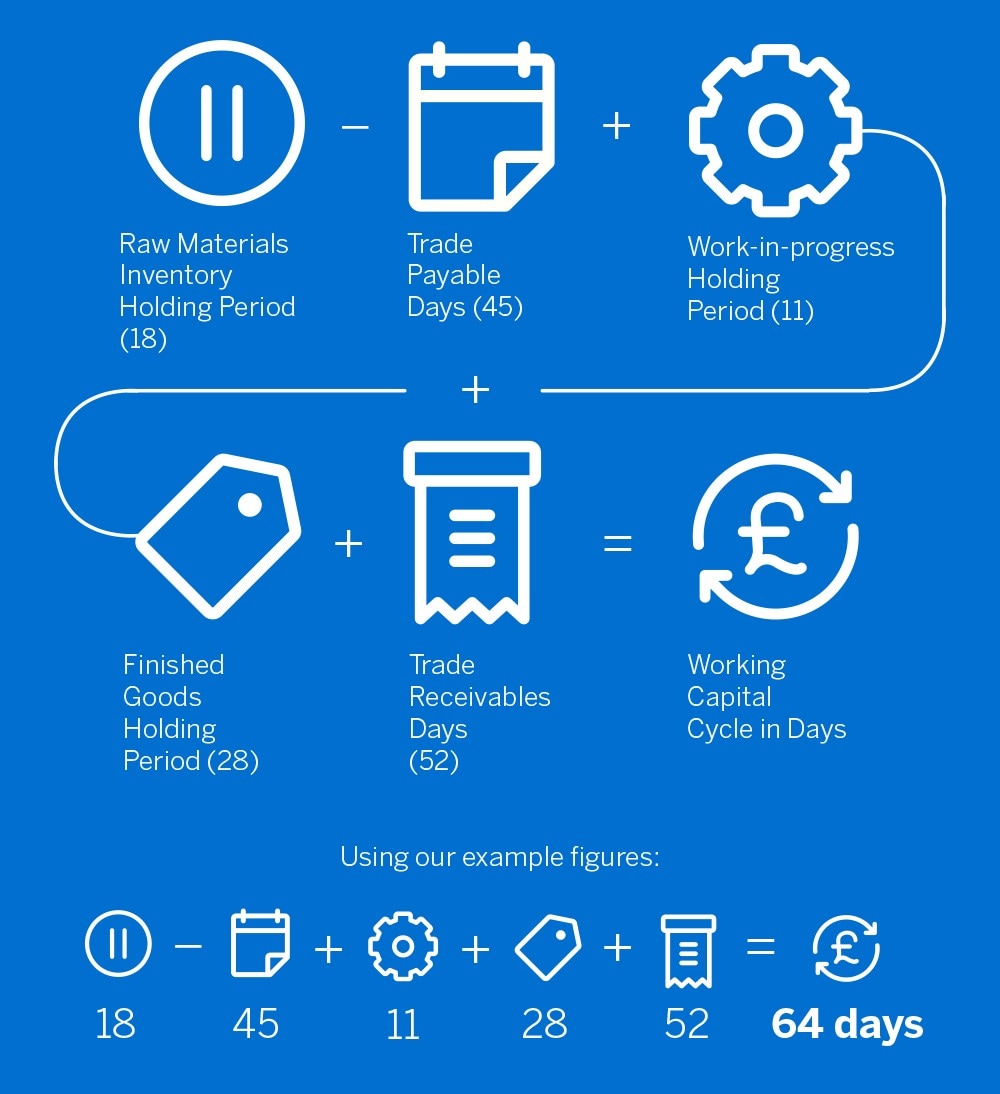

Ad Turn your outstanding invoices and accounts receivable into working capital. Working Capital Current Assets Current Liabilities. The Working Capital Cycle for a business is the length of time it takes to convert net working capital current assets less current liabilities all into cas.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_You_Calculate_Working_Capital_Aug_2020-01-a35d03d74be84f8aa3ad4c26650142f6.jpg)

How Do You Calculate Working Capital

How To Grow Your E Commerce Business With Working Capital In 2021 E Commerce Business Small Business Finance Business

Working Capital Formula Youtube

Working Capital Cycle Definition How To Calculate

Working Capital Cycle Understanding The Working Capital Cycle

Working Capital What Is Working Capital Youtube

Working Capital Financial Edge Training

Treasury Essentials The Cash Conversion Cycle The Association Of Corporate Treasurers

Working Capital Cycle What Is It With Calculation

Working Capital Cycle What Is It With Calculation

Days Working Capital Formula Calculate Example Investor S Analysis

Best Business Loans With Bad Credit For Women Business Loans Small Business Loans Bad Credit

Immediate Financing Options Trade Finance Supply Chain Finance

Business Financing Small Business Advice Business Funding Business Advice

Working Capital Cycle Understanding The Working Capital Cycle

/WORKINGCAPITALFINALJPEG-4ca1faa51a5b47098914e9e58d739958.jpg)